FINANCIAL ADVICE PROVIDER DISCLOSURE INFORMATION

IMPORTANT INFORMATION ABOUT ELITEINSURE

Version 1.0 Effective from 15th March 2021

What sets us apart?

-

- Eliteinsure has been in the financial industry since March 2016. We are a ‘close-knit’ team of professionals with a wealth of experience.

- We work tirelessly for our clients and aim to offer them the best-customized solutions for their insurance and investment needs.

- We annually offer insurance and investment reviews for our clients.

- If and when the need to claim arises, we will support you in the claim process.

What is the purpose of this document?

-

- This information is what you need to know before we can give you the advice that best suits your needs.

Nature and Scope of Engagement

-

- Eliteinsure provides advice and service on a range of different needs related to clients personal and business risk insurance, health insurance and investment needs.

- Personal and Business Insurance:

- We work with 6 providers that offer a range of products depending on client’s unique needs which include:

- AIA, Asteron Life, Chubb Life, Fidelity Life, NIB and Partners Life.

- We work with 6 providers that offer a range of products depending on client’s unique needs which include:

- Health Insurance:

- We work with 4 providers that offer a range of different medical products including:

- AIA, NIB, Partners Life and Southern Cross.

- We work with 4 providers that offer a range of different medical products including:

- Investment Advice:

- We work with 3 providers that offer different solutions such as KiwiSaver and other managed funds:

- Booster, Consilium and NZFunds.

- We work with 3 providers that offer different solutions such as KiwiSaver and other managed funds:

- Personal and Business Insurance:

- In providing advice we are limited to insurance and investment providers that we have an agreement with.

- Eliteinsure provides advice and service on a range of different needs related to clients personal and business risk insurance, health insurance and investment needs.

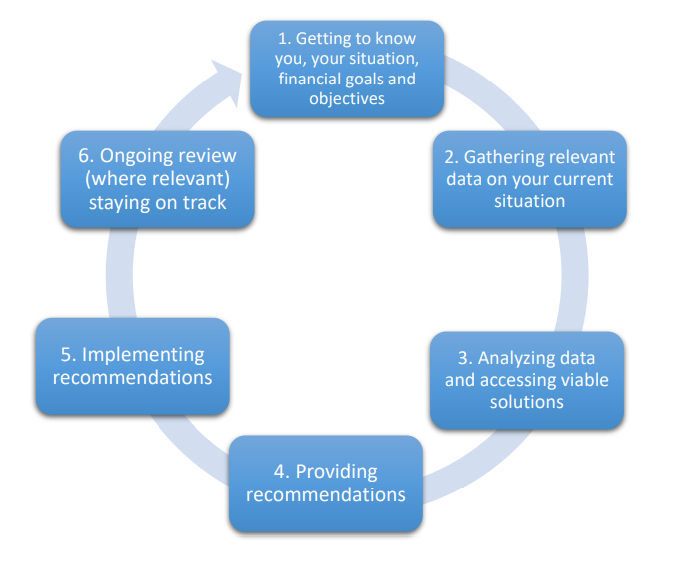

How do we operate?

- We follow an internationally recognised Six-Step Professional Advice Process to ensure our recommendations are made on the basis of the client’s goals and circumstances.

Duties

-

- Eliteinsure, and anyone who gives financial advice on our behalf, have duties under the Financial Markets Conduct Act 2013 relating to the way that we give advice.

We are required to:

-

-

- Give priority to your interests by taking all reasonable steps to make sure our advice isn’t materially influenced by our own interests;

- Exercise care, diligence, and skill in providing you with advice; and

- Meet the standards of competence, conduct and client care, ethical behavior and knowledge and skill set by the Code of Professional Conduct for Financial Advice Services.

-

-

- This is only a summary of the duties that we have. More information is available by contacting us, or by visiting the Financial Markets Authority website at https://www.fma.govt.nz.

Remuneration

-

- Typically, we are remunerated by way of commissions received directly from product providers as demonstrated in the remuneration table below:

REMUNERATION TABLE PRODUCTS SHOULD ANY NEW RISK INSURANCE BE PLACED, WE WILL BE ENUMERATED BY THE WAY OF: PROVIDERS PAYMENT TYPE UPFRONT ONGOING PAYMENT BUSINESS OVER-RIDE Risk Insurance Commission AIA, Asteron, Chubb Life, Fidelity Life and Partners Life 20-220% 3-33% 0-30% Health Insurance Commission AIA, NIB, Partners Life, and Southern Cross 30 – 140% 5-15% 0-10% Investment Products Commission NZFunds, Booster and Consilium $0-$300 0.4-1% None

- Advisers who are contracted by Eliteinsure who give financial advice on our behalf, except those who are employed directly by us, will receive 50% to 100% of the commissions paid to Eliteinsure by the insurers and investment providers. This depends on their skill, seniority and experience. Advisers who are employed are paid a salary with the potential bonus that is based on the quality of advice and productivity.

- Typically, we are remunerated by way of commissions received directly from product providers as demonstrated in the remuneration table below:

Fees and Expenses

Related to Insurance

-

- We may charge a fee for the financial service I provide if you cancel a life or health insurance policy within two years of inception. This will be calculated on the amount the product provider charges us. This is known as a clawback. A clawback is where a payment received from product providers for business placed may be reversed due to the Insurance policy being cancelled by the client within a 24-month period.

- This charge is based on the commission percentage Eliteinsure receives which can be roughly estimated on the annual premium (as an initial estimation). This fee cannot exceed either the clawback amount or $5,000 whichever is lesser. This fee must be paid in full within 7 days of invoice, or you can proceed with a payment plan approved by Eliteinsure.

Related to Investment

-

- At Eliteinsure, we offer investment services that are subject to two types of fees: an upfront fee for Tiers 2 and 3, and an ongoing fee. The ongoing fee typically ranges between 0.5% – 1.5% of the invested funds, depending on the investment solution implemented. The level of service is agreed upon before any service is provided, with the following options available to our clients:

-

- Tier 1 – No Upfront Cost: This tier offers a basic service where we can assist in implementing a simple strategy, such as setting up a new KiwiSaver scheme. Please note that this level of service does not include a written financial plan.

- Tier 2 – $500 Upfront Cost: This tier includes the provision of a written financial plan. However, it does not include a detailed portfolio analysis or projections.

- Tier 3 – Hourly Rate of $200, Capped at $6,000: This comprehensive service includes a detailed portfolio analysis, projections, and a written financial plan. An estimate of the time required will be provided at the start of engagement, typically ranging between 5 – 15 hours for most clients.

-

- At Eliteinsure, we offer investment services that are subject to two types of fees: an upfront fee for Tiers 2 and 3, and an ongoing fee. The ongoing fee typically ranges between 0.5% – 1.5% of the invested funds, depending on the investment solution implemented. The level of service is agreed upon before any service is provided, with the following options available to our clients:

Please note that all upfront fees are agreed upon before any service is provided, ensuring transparency and understanding for our clients.

Conflict of Interest

-

- We take any perceived or real conflicts of interest very seriously and have a dedicated policy for dealing with such issues. We are obligated to disclose and/or manage any conflicts of interest so that our client’s interest is placed first and foremost.

- For life insurance, health insurance and Investment products, Eliteinsure and our financial advisers receive commissions from the insurance companies on whose policies we advise on. If you decide to take out insurance or investment solution, the insurer will pay a commission to Eliteinsure and your financial adviser will receive their share of that paid commission. The amount of the commission is based on the amount of the premium.

- From time to time, product providers may also reward us for the overall business we provide to them. This may include but is not limited to tickets to sports events, hampers, or other incentives.

- All our financial advisers undergo annual training on how to manage conflicts of interest. We undertake a compliance audit and a review of our compliance programme annually by a reputable compliance adviser.

- We take any perceived or real conflicts of interest very seriously and have a dedicated policy for dealing with such issues. We are obligated to disclose and/or manage any conflicts of interest so that our client’s interest is placed first and foremost.

Complaints handling and dispute resolution

-

- If you are not satisfied with our financial advice services, you can raise a complaint by emailing it to admin@eliteinsure.co.nz or go to the complaints page of our website at https://www.eliteinsure.co.nz/complaints/, and or by calling us at 0508123467. You can also write us addressing to Eliteinsure Ltd., 27C Mauranui Avenue, Epsom, Auckland 1051, New Zealand.

- When we receive a complaint, we will consider it by following our internal complaints process:

- We will acknowledge your complaint within 2 days upon receipt and try to resolve it within 10 days. We may need to ask you for further information or agree on an extension if the issue is complex or there are issues outside our control.

- If we cannot agree on how to resolve the complaint, we will send you a letter of deadlock. You may then contact our Dispute Resolution Scheme, Financial Services Complaints Ltd (FSCL). Financial Services Complaints Ltd (FSCL) is an external financial dispute resolution scheme approved by the Minister of Consumer Affairs under the Financial Service Provider (Registration and Dispute Resolution) Act 2008.

- The Scheme can be contacted at info@fscl.org.nz or 0800347257.

- They will investigate your complaint and work to facilitate an agreed resolution. If this is not possible the Scheme may make a formal decision that is binding on Eliteinsure Ltd, but not you unless you accept the decision. The process is free for you and the Scheme will assist you to lodge your complaint.

Ask us – we are here to help

-

- We welcome any questions or queries you have in relation to this important information by sending us an email at admin@eliteinsure.co.nz or by calling us at 0508123467. Once received, we will address your questions or queries accordingly and it’s absolutely free of charge.