What is KiwiSaver?

KiwiSaver is a voluntary savings scheme set up by the government to help New Zealanders to save for their retirement.

You can choose to contribute 3%, 4%, 6%, 8% or 10% of your gross (before tax) wage or salary to our KiwiSaver account. Your employer has to contribute as well – at least 3% of your gross salary.

Along with KiwiSaver employer contributions, there’s an annual government contribution as well.

Your savings are invested on your behalf by the KiwiSaver provider of your choice. If you don’t choose a provider, Inland Revenue will assign you to one of the nine default KiwiSaver schemes.

How are contributions made?

For many people, KiwiSaver will be work-based. This means you’ll receive information about KiwiSaver from your employer, and your KiwiSaver contributions will come straight out of your pay.

If you choose to join, contributions are deducted from your pay at the rate of either 3%, 4%, 6%, 8% or 10% (you choose the rate) and invested for you in a KiwiSaver scheme.

If you’re self-employed or not working, you agree with your KiwiSaver provider how much you want to contribute, and make payments directly to them.

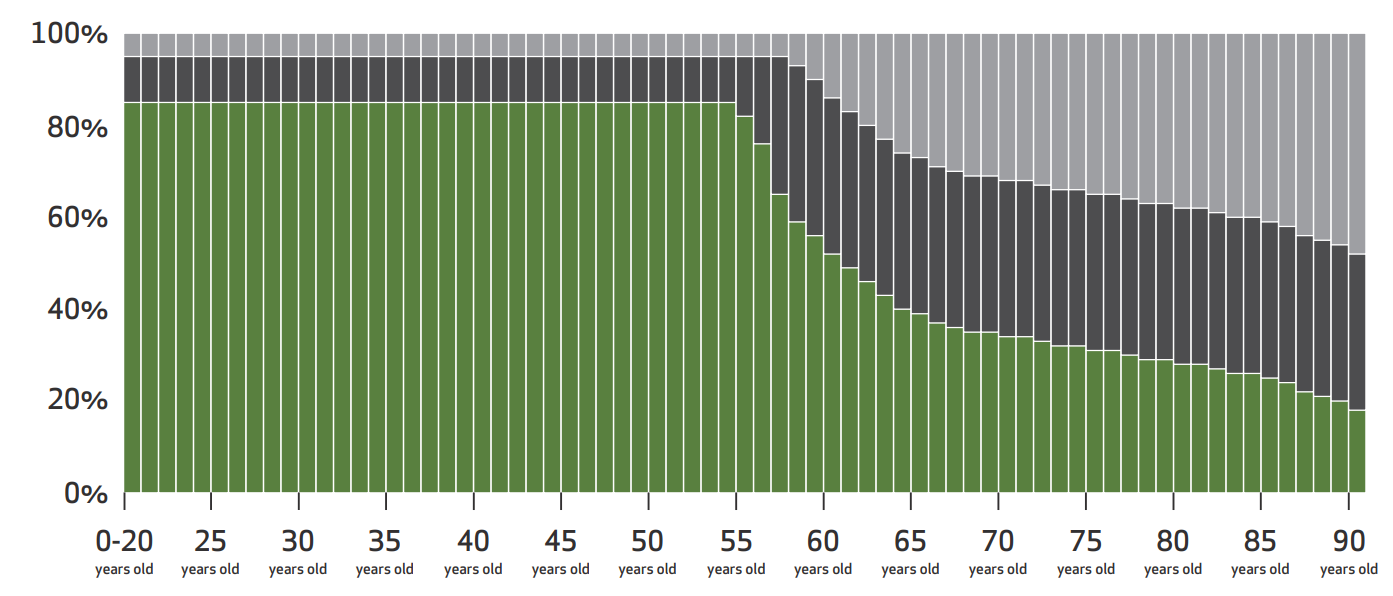

When you can use your funds?

Your KiwiSaver savings will generally by locked in until:

- you’re eligible for NZ Super (currently 65)

- you’ve been a member for at least 5 years (if you joined over the age of 60)

You may be able to make an early withdrawal of part (or all) of your savings if you are:

- buying your first home

- moving overseas permanently

- seriously ill

By investing in the NZ Funds KiwiSaver Scheme, you would have benefited from a scheme earning higher than average returns.

NZ Funds’ KiwiSaver scheme invests with world class global managers so that members get professionally managed local and international investments.

Members have access to market leading technology to check, calculate or change investment, so they remain closely connected with their KiwiSaver account

NZ Funds’ globally diversified approach ensures that members are invested both locally and internationally, so that their savings are not dependent on any one economy.